2ピース フロント フォグライト アイブロー アイリッド カバー トリム フォグライト ランプ プロテクター 適用: A カーボンファイバー AL-MM-4918 AL

(税込) 送料込み

商品の説明

商品情報

automobile motorcar オートモービル モーターカー カー 車 自動車 車両 フォグ ライト ランプ トヨタ TOYOTA トヨタ自動車 CORALLA ALTIS COROLLA

6870円2ピース フロント フォグライト アイブロー アイリッド カバー トリム フォグライト ランプ プロテクター 適用: A カーボンファイバー AL-MM-4918 AL車、バイク、自転車自動車輝く高品質な (まとめ)ステッドラー 油性マーカー ルモカラーデュオ M

【バリエーション】

タイプ001:A カーボンファイバー

2ピース フロント フォグライト アイブロー アイリッド カバー トリム フォグライト ランプ プロテクター 適用: トヨタ カローラ アルティス 2019 2020 アクセサリー楽天市場】2ピース フロント フォグライト アイブロー アイリッド

楽天市場】2ピース フロント フォグライト アイブロー アイリッド

代引き人気 2ピース フロント フォグライト アイブロー アイリッド

代引き人気 2ピース フロント フォグライト アイブロー アイリッド

Amazon.co.jp: ドライカーボンファイバーフォグランプカバー適合

楽天市場】2ピース フロント フォグライト アイブロー アイリッド

代引き人気 2ピース フロント フォグライト アイブロー アイリッド

2ピース フロント フォグライト アイブロー アイリッド カバー トリム

スタイルブランド 2ピース フロント フォグライト アイブロー

代引き人気 2ピース フロント フォグライト アイブロー アイリッド

2ピース ヘッドライト ヘッド ライト ランプ アイブロー アイリッド カバー トリム 適用: スマート 453 フォーツー用 2015-2021 アクセサリー エクステリア レッド AL-PP-0173 AL Exterior parts for cars | オートパーツエージェンシー

BRIGHTZ ポルテ 140 141 145 メッキフォグライトカバー FOG−COV−294

2ピース フロント フォグライト アイブロー アイリッド カバー トリム

Amazon.co.jp: ドライカーボンファイバーフォグランプカバー適合

BRIGHTZ カローラフィールダー 161 162 164 165 後期 メッキフォグ

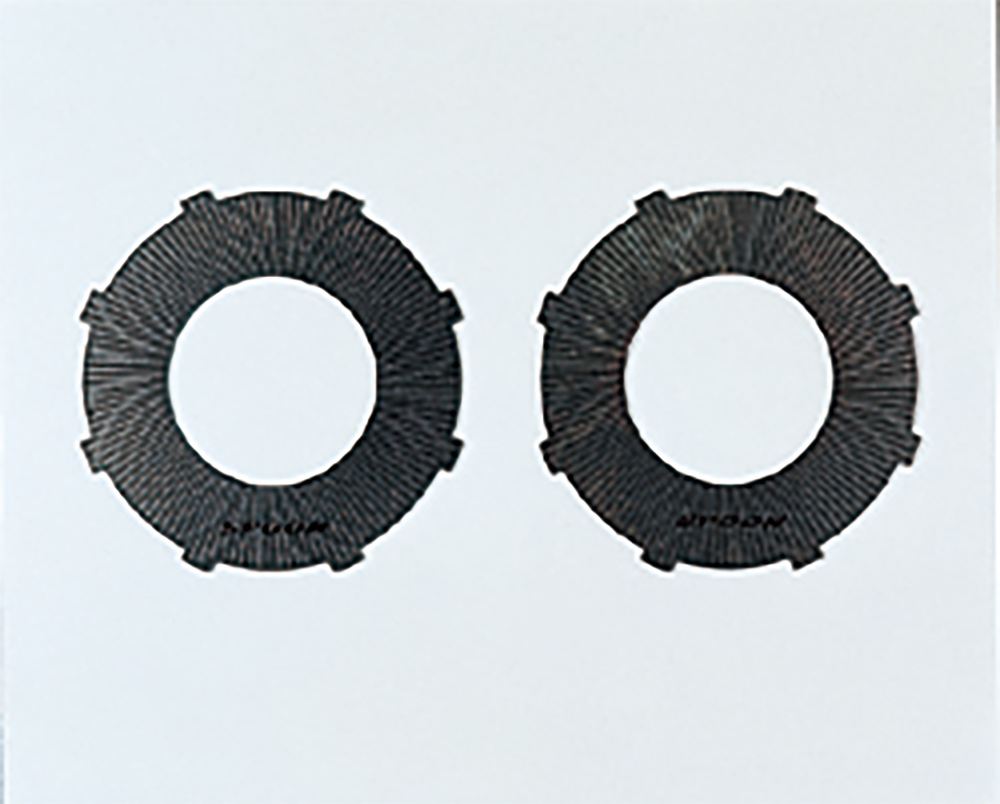

休日限定 SPOON CLUTCH PLATE SET インテグラ DC2タイプR'98Spec B18C

楽天市場】2ピース フロント フォグライト アイブロー アイリッド

東京銀座販売 ABS 自動車 ブレーキ コントロール パネル トリム 適用

BRIGHTZ ポルテ 140 141 145 メッキフォグライトカバー FOG−COV−294

2ピース フロント フォグライト アイブロー アイリッド カバー トリム

即納在庫有 ドアハンドルステッカー 装飾 メルセデスベンツ C クラス

MR-Wagon Brake Pads フロント ハイエース KZH110G 品番:49237

ASSO International ASSPIDE フォグランププロテクター For ABARTH595

Amazon.co.jp: ドライカーボンファイバーフォグランプカバー適合

BRIGHTZ クラウンハイブリッド RS 20 21 224 メッキフォグライトカバー

Nielex ニーレックス プロスペックトラクションカラー ロードスター NA

Lisette リゼット フロアライト | 照明,フロアライト | INTERFORM INC

今年も話題の 【中古】GUCCI◇リング/SV925/20号/SLV/メンズ【服飾雑貨

楽天市場】2ピース フロント フォグライト アイブロー アイリッド

輝く高品質な (まとめ)ステッドラー 油性マーカー ルモカラーデュオ M

ペア 【ポイント5倍】東日製作所 (TOHNICHI) トルクゲージ BTGE20CN

Nielex ニーレックス プロスペックトラクションカラー ロードスター NA

MLSE1 XT250用 LEDフォグライトKIT 6000K PIAA(ピア) [MLSE1

Lisette リゼット フロアライト | 照明,フロアライト | INTERFORM INC

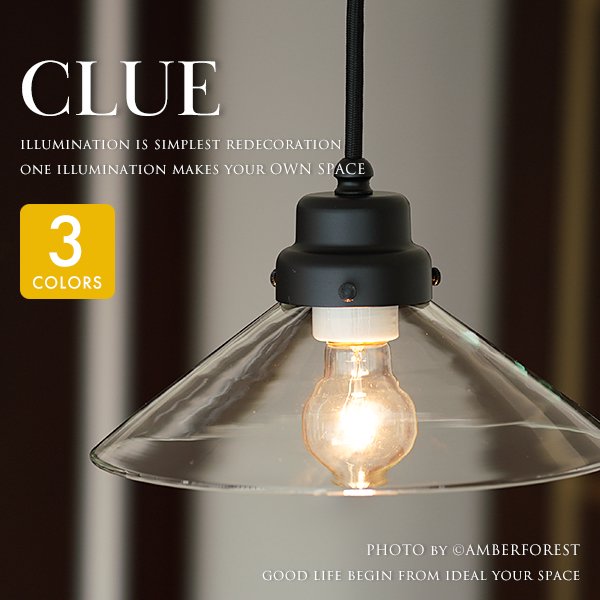

GLF-3226 - 後藤照明の取扱店 AMBER FOREST

BROMPTON専用フロントライト】まさかまさかの再入荷コレがホントの

2ピース フロント フォグライト アイブロー アイリッド カバー トリム

BRIGHTZ ポルテ 140 141 145 メッキフォグライトカバー FOG−COV−294

照明 Felitto Floor Light フェリット フロアライト 照明 フロアライト

販売直販店 ヘッド フロント フォグライト アイリッド 装飾 カバー

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています